Co-authored by James Mc Keever

Key Takeaways

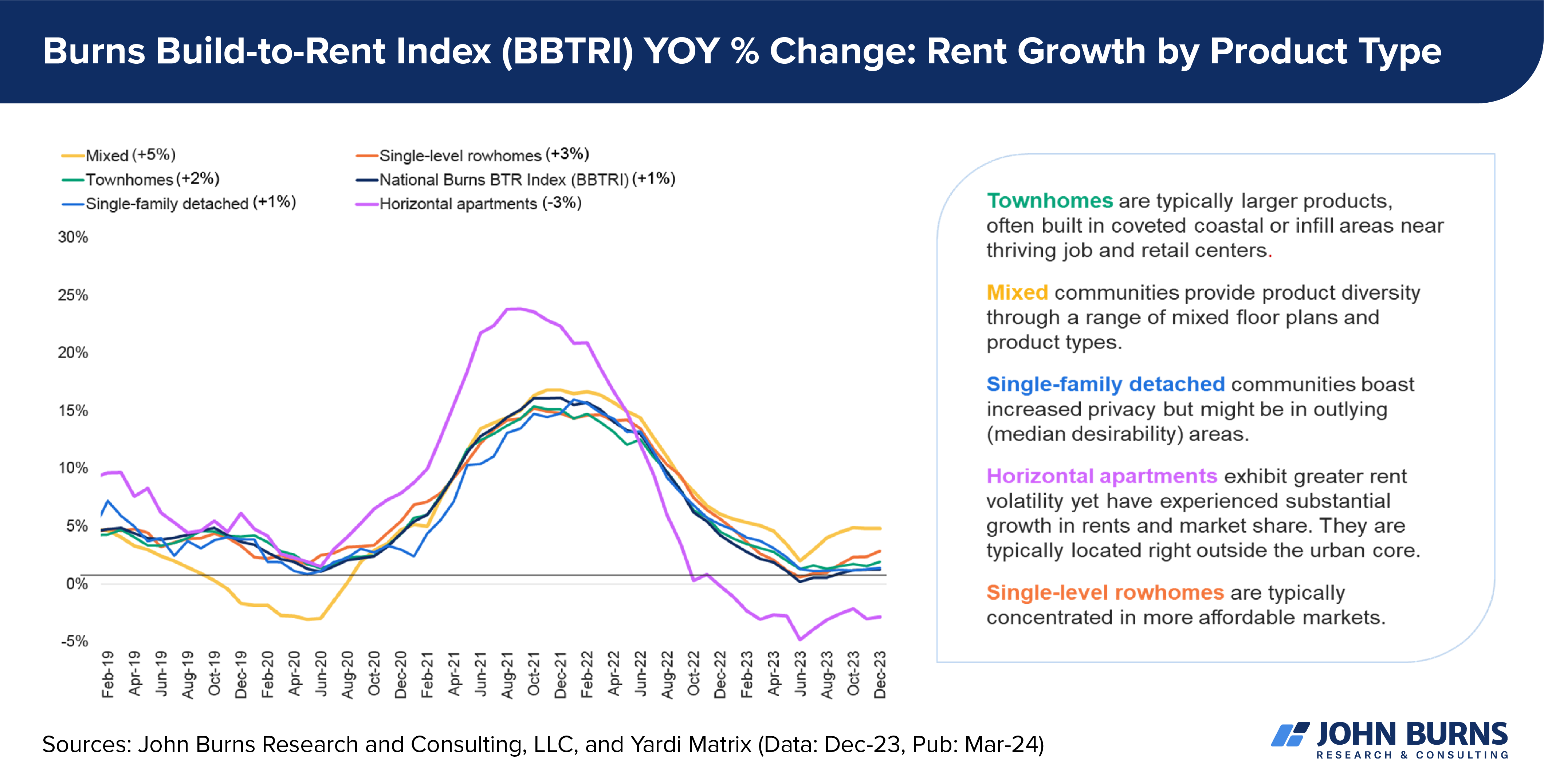

- All build-to-rent (BTR) product types (except horizontal apartments) show signs of returning to pre-pandemic growth levels.

- Tenant priorities differ vastly by product type, so strategies to maximize rent growth must differ too.

BTR rent growth across product types has moderated from peaks in 2021. Signs of growth are returning.

The BTR industry benefited from household formation and robust demand in 2020 and 2021, with double-digit BTR rent growth across all product types. However, BTR rent growth across product types slowed in 2023 as new supply, moderating migration, and the impact of inflation on housing budgets weighed on rent growth.

All BTR product types (except horizontal apartments) show signs of returning to pre-pandemic growth levels. See the chart below.

After years of analyzing the build-to-rent (BTR) sector, we recently released BTR rent growth by product type in our Rental Communities Analysis and Forecast report. Last July, we published the inaugural BTR Tenant Survey Insights Report, which analyzed responses from over 6,000 BTR tenants across the US.

Our Consulting team conducts BTR market studies to provide rent and lease-up recommendations. These reports often include input on the target tenant, the right rental product to build, floor plans, community amenities and services to be offered, and the associated revenue premiums to expect.

Mixed communities (+5% YOY rent growth) offer product diversity to renters through a range of mixed product types and floor plans. Diverse product types appeal to various tenant preferences and support rental demand as the market normalizes.

Single-level rowhomes (+3% YOY rent growth) are typically concentrated in more stable markets with less pronounced boom-and-bust cycles and may not be as directly impacted by new supply. They exhibit less volatility in rent fluctuations and deliveries and are favored by retirees.

Townhomes (+2% YOY rent growth) have larger floor plans than other product types and are often located in coveted infill areas and urban cores, making them highly popular with renters. Townhomes comprise 40% of existing BTR inventory and 22% of the coming-soon pipeline. They represent the highest proportion of luxury products in our sampled inventory.

Single-family detached homes (+1% YOY rent growth) comprise 24% of the pipeline. Builders often move to outlying areas to build single-family detached homes. Renters may trade privacy and space for a less desirable submarket.

Horizontal apartments (-3% YOY rent growth) are popular with builders and posted significant rent growth in 2021 and 2022. Competition (oversupply of horizontal and garden apartments in some metros) and a slowdown in demand weigh on the product type now.

Our inaugural BTR Tenant Survey helps you maximize rents by product type.

Insights from over 6,000 tenants reveal a diverse range of preferences by community type.

Single-level rowhome communities:

- Rowhomes attract more mature tenants, so accessible design is a higher priority, and yards matter much less.

- Bulk storage is a key desire of these tenants, as many have accumulated possessions for which they need space.

The main draw: a single-family home environment with on-site maintenance and management

Townhome communities:

- Townhome tenants say they enjoy living in a rental option that offers multiple stories, providing them more space and separation than an apartment would.

The main draw: More space—and often a garage—at a more attainable price attracts tenants to these communities.

Single-family detached communities:

- Tenants call out bedroom count and spaciousness when describing their favorite features and features that make the space live like a home versus an apartment (e.g., a laundry room or walk-in storage).

The main draw: more space, specifically bed count and gathering areas like the kitchen

Horizontal apartment communities:

- A private, fenced backyard matters more to these tenants—it is likely the feature driving their rental decisions. No one living above or below is also appealing.

- Tenants acknowledge the tight living spaces but accept them when offset by an open layout and high ceilings.

The main draw: a home with a private backyard, often fenced, for pets and outdoor activities

We constantly monitor how different factors affect BTR rent growth across the country, including rent premiums. If you need help maximizing revenue for your BTR project or are interested in staying up to date on all the BTR demand, supply, and affordability trends, please contact us.