Key Takeaways

- Consumer confidence declined in our March Household Sentiment Survey: Consumers grew more pessimistic about their personal finances, the housing market, and the macroeconomic backdrop (including inflation and tariffs).

- Department of Government Efficiency (DOGE) cuts to federal spending and staffing have already impacted 1 in 10 households, and consumers continue to feel less secure in their jobs.

- Just 20% of consumers believe now is a good time to buy a home, down from 26% in December 2024. Consumers are still waiting for lower mortgage rates before reentering the market: 78% of prospective homebuyers believe rates will drop below 5.5% within a year.

Before the April 2 tariff announcements, our New Home Trend Institute’s Household Sentiment Survey picked up a notable decline in consumer sentiment regarding their personal finances, the housing market, and the macroeconomy. We conducted our most recent survey from March 7 to 16 and gathered responses from 1,271 households.

“All of our consumer and industry channel checks are telling us that consumers are in wait-and-see mode this spring. Buyers are naturally hesitant to commit to large purchases when the macroeconomic backdrop is changing rapidly.”

Rick Palacios Jr., Director of Research and Managing Principal

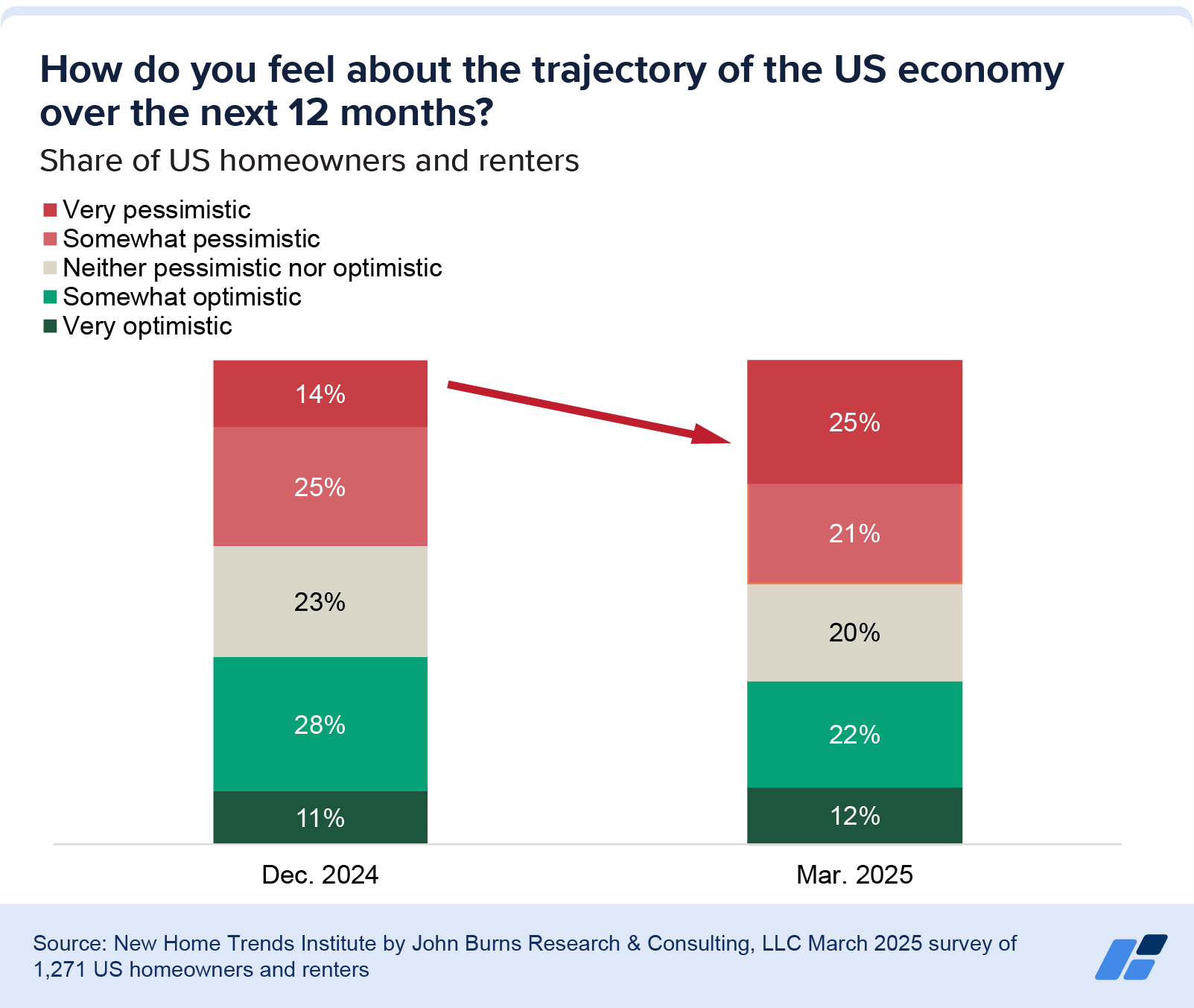

Consumers feel less optimistic about the trajectory of the US economy

Economic uncertainty is weighing heavily on consumer confidence. Just 34% of consumers are optimistic about the trajectory of the US economy over the next year, down from 39% in December 2024. Meanwhile, the share of very pessimistic consumers jumped more than +10 percentage points quarter over quarter (QOQ).

Consumers principally blamed their pessimistic outlook on inflation and the political climate.

- 51% of households have tighter budgets this year compared to last year, and a majority of those consumers are tightening their budgets by cutting discretionary spending (70%), switching to less expensive brands (59%), or delaying large purchases like cars, homes, or renovations (50%).

- Concerns over tariffs and immigration policy shifts also featured heavily in the commentary we received this quarter.

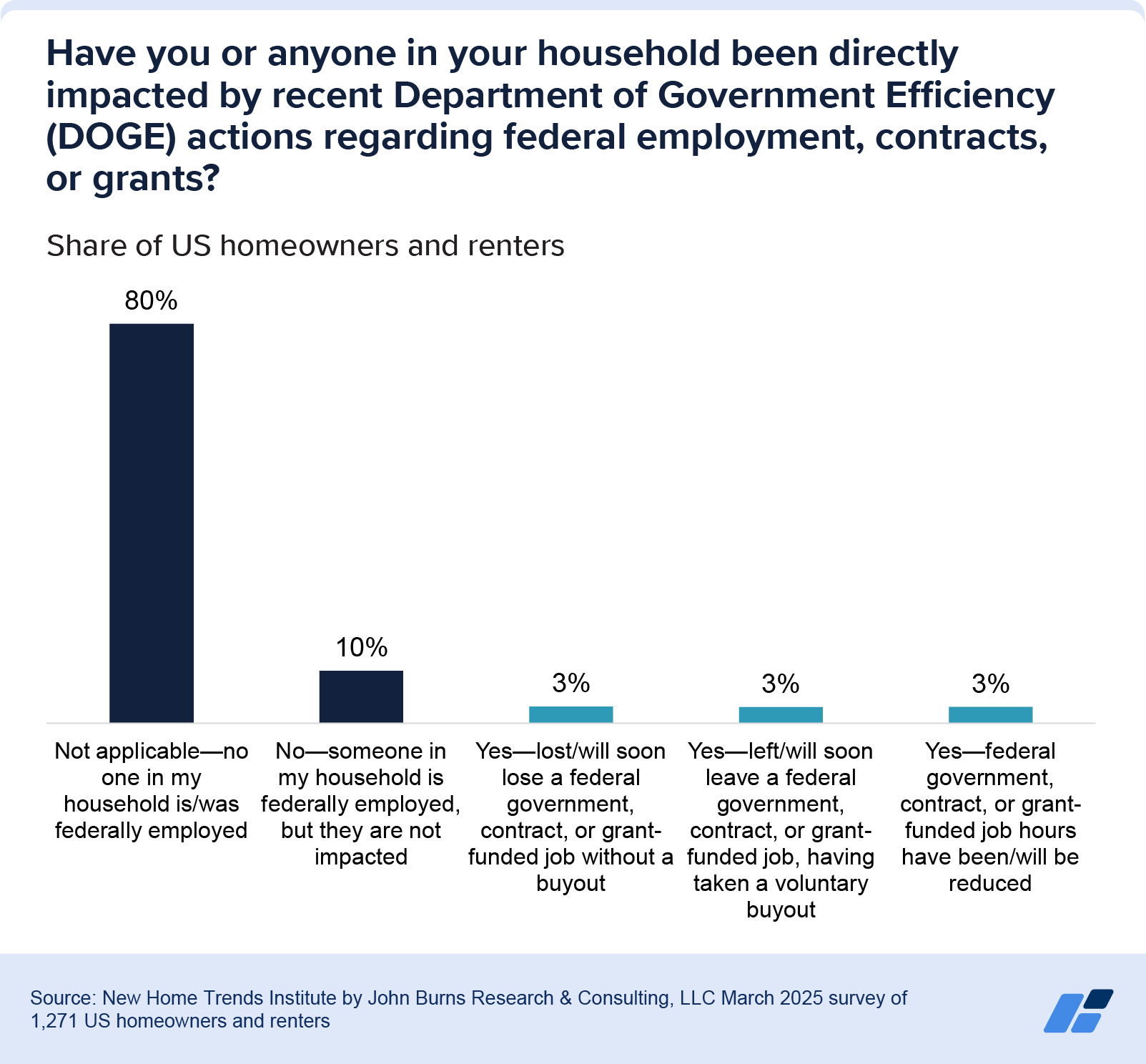

DOGE federal spending cuts have impacted about 1 in 10 US households

Despite being created only 3 months ago, DOGE actions have already impacted about 1 in 10 US households, per our survey.

- 3% reported a job loss due to DOGE-related restructuring

- 3% accepted or plan to accept a voluntary buyout

- 3% experienced reduced hours

This may seem high, but federally supported employment is a significant pillar of the full-time workforce. The federal government directly employs 3.8 million workers across the civil service, the postal service, and the military. It also supports another 7.5 million full-time equivalent positions—5.2 million through contractors and 2.3 million through grantees—according to 2023 Brookings estimates. Together, 11.3 million federally supported workers equate to around 8% of the full-time workforce.

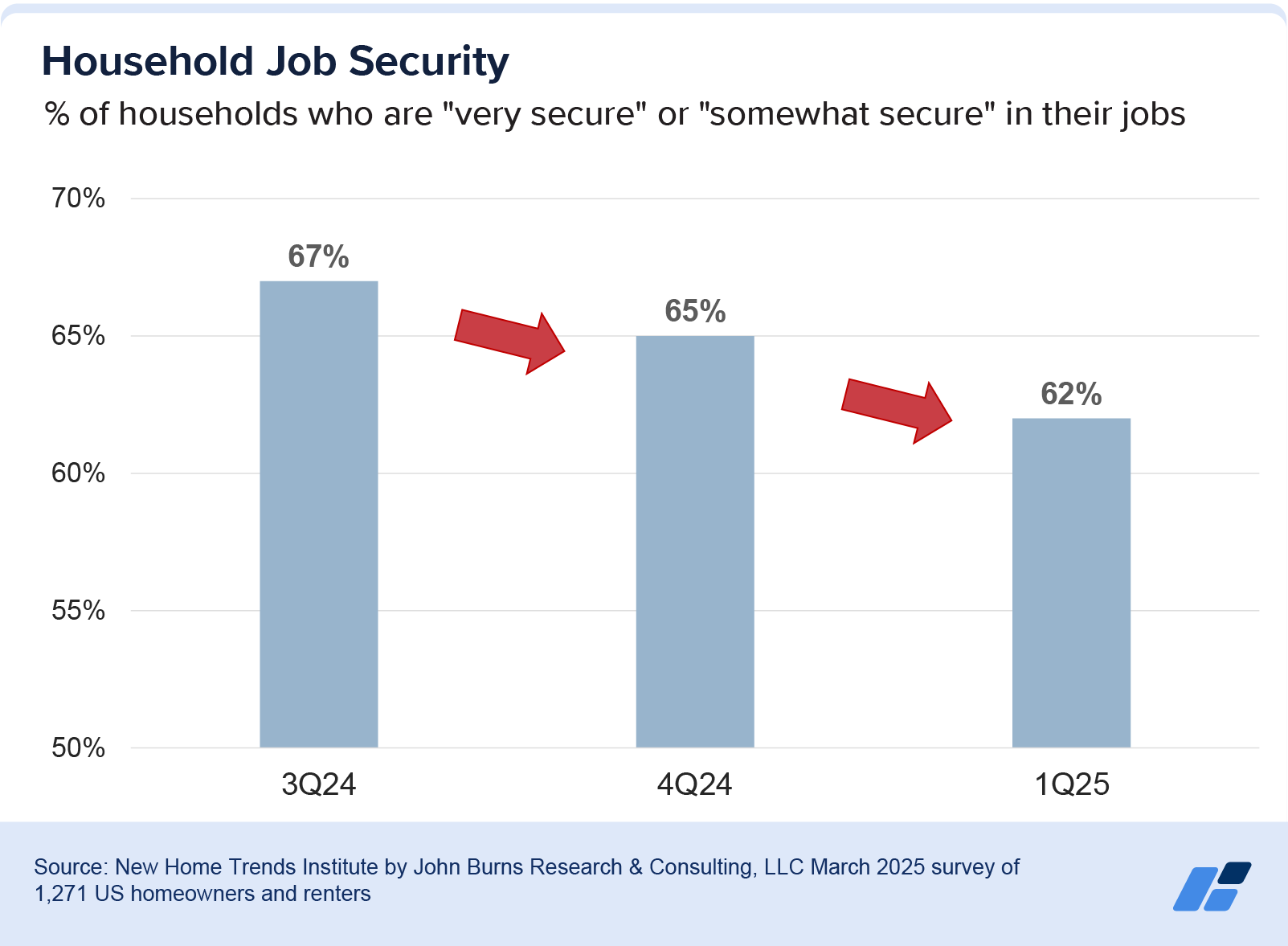

Perceived job security has also waned over the past 3 quarters. The share of consumers who feel secure in their jobs fell to 62% in March, down from 65% in December 2024 and 67% in September 2024.

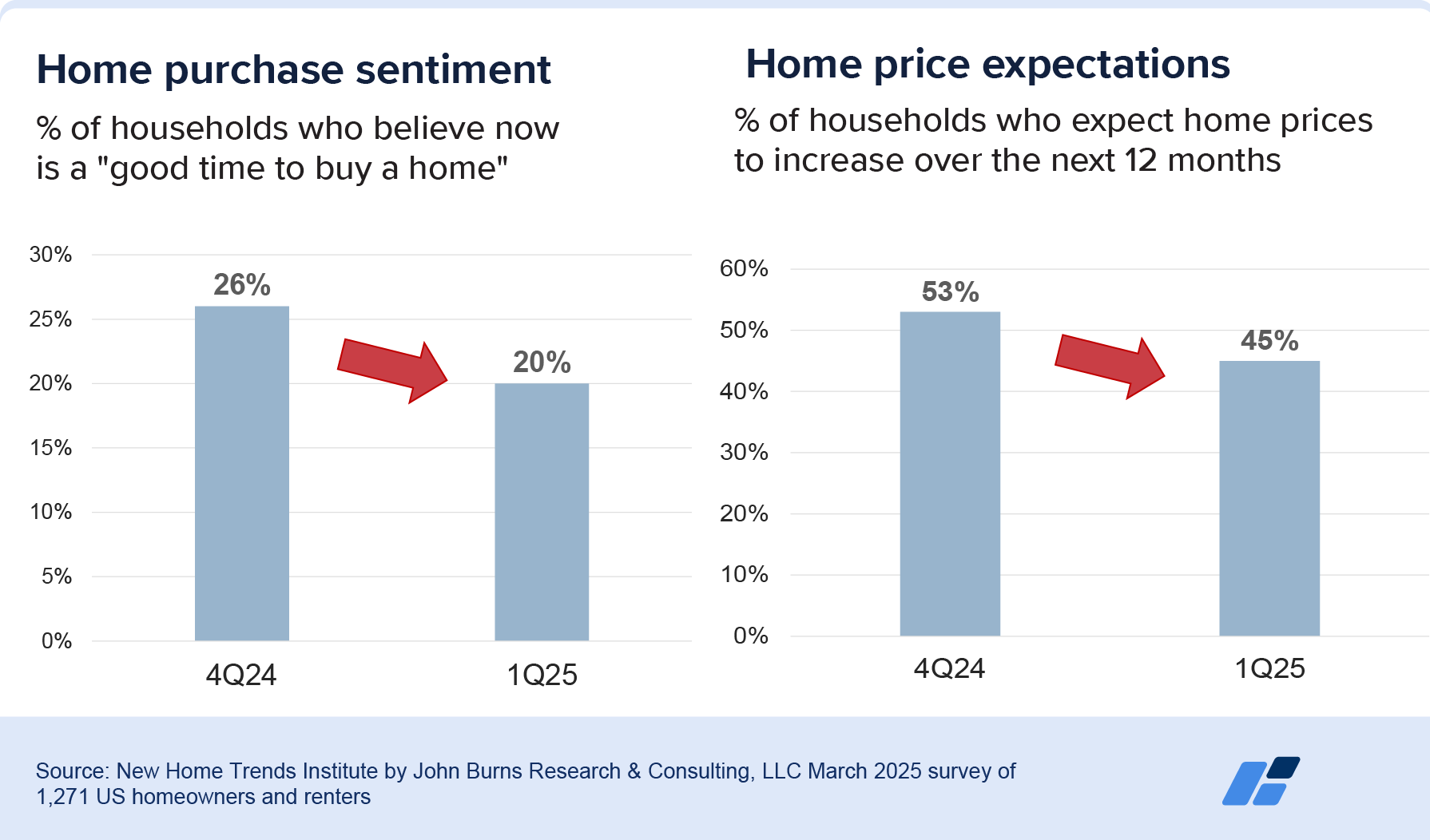

Is it a good time to buy a house? Consumers say no

Consumer sentiment related to homebuying dropped QOQ in our most recent survey. Just 20% of consumers believe today is a good time to buy a home, down from 26% in 4Q24 (which was already quite low).

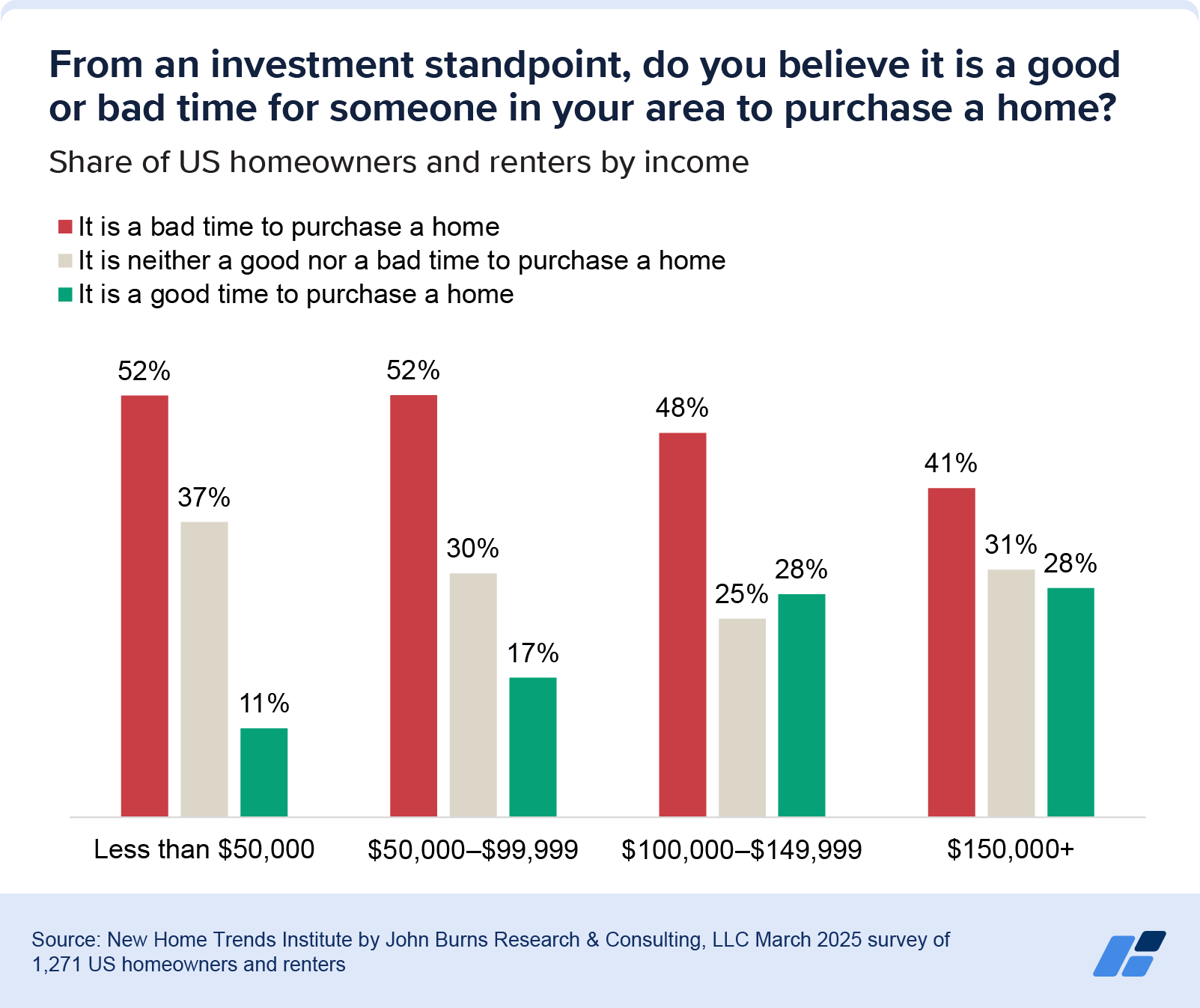

Even at higher income levels, consumers are less than enthusiastic about today’s homebuying environment. 41% of households earning $150K or more per year believe it is a bad time to buy a home, just below the ~50% of households earning less than $150K who believe it is a bad time to buy a home.

Uncertainty is keeping prospective homebuyers on the sidelines. 13% of consumers are actively shopping for a home today, but this share would rise to 20% if those who “would be actively shopping if not for current market conditions” entered the market. Of those not actively shopping for a home, 7% had previous homebuying plans that they have since paused due to market conditions.

More than half (55%) of consumers expect home values to remain flat or fall in their area over the next 12 months as the macroeconomic backdrop shifts rapidly. Buyers often become more cautious when they anticipate a decline in home prices and may feel less pressure to act quickly on a property that could lose value in the near term.

Most consumers’ homebuying plans will likely remain in limbo as they wait for signs of market stability. Prospective homebuyers continue to hold out hope for a return to sub-5.5% mortgage rates, with 78% believing that rates will return to historic lows of the recent past within the next year. As in our prior surveys, 5.5% continues to be the “magic mortgage rate” for consumers, the rate at which we would expect housing demand to unlock at scale.

Our team consistently monitors consumer sentiment as a leading indicator of residential housing demand. For more information, please contact us.