Key takeaways

- More build-to-rent (BTR) residents consider themselves renters by preference compared to 2023 (36% in 2024 vs. 27%, respectively).

- Residents’ expected time in their current home hasn’t changed (most plan to stay for a median of 3 years), but fewer plan to buy a home next. The percentage planning to purchase a home has dropped 7 percentage points since 2023.

- 43% of BTR residents would move if they found a better deal on rent in another community.

BTR homes provide an affordability solution in today’s increasingly expensive housing market, but don’t ignore the implications of a cost-conscious consumer. While more BTR residents prefer renting, their planned length of stay hasn’t changed. Many are sensitive to price and are willing to move for a better deal.

More BTR residents consider themselves renters by preference

Our second national Build-to-Rent Resident Survey¹, conducted in 2024, gathered over 7,600 responses from residents across the US. The results highlight key shifts in renter preferences compared to 2023. 36% of BTR residents said they prefer renting their homes, up from 27% in 2023. This increase was consistent even when comparing survey responses only from residents at BTR communities that participated in both years, ruling out bias from new participating communities.

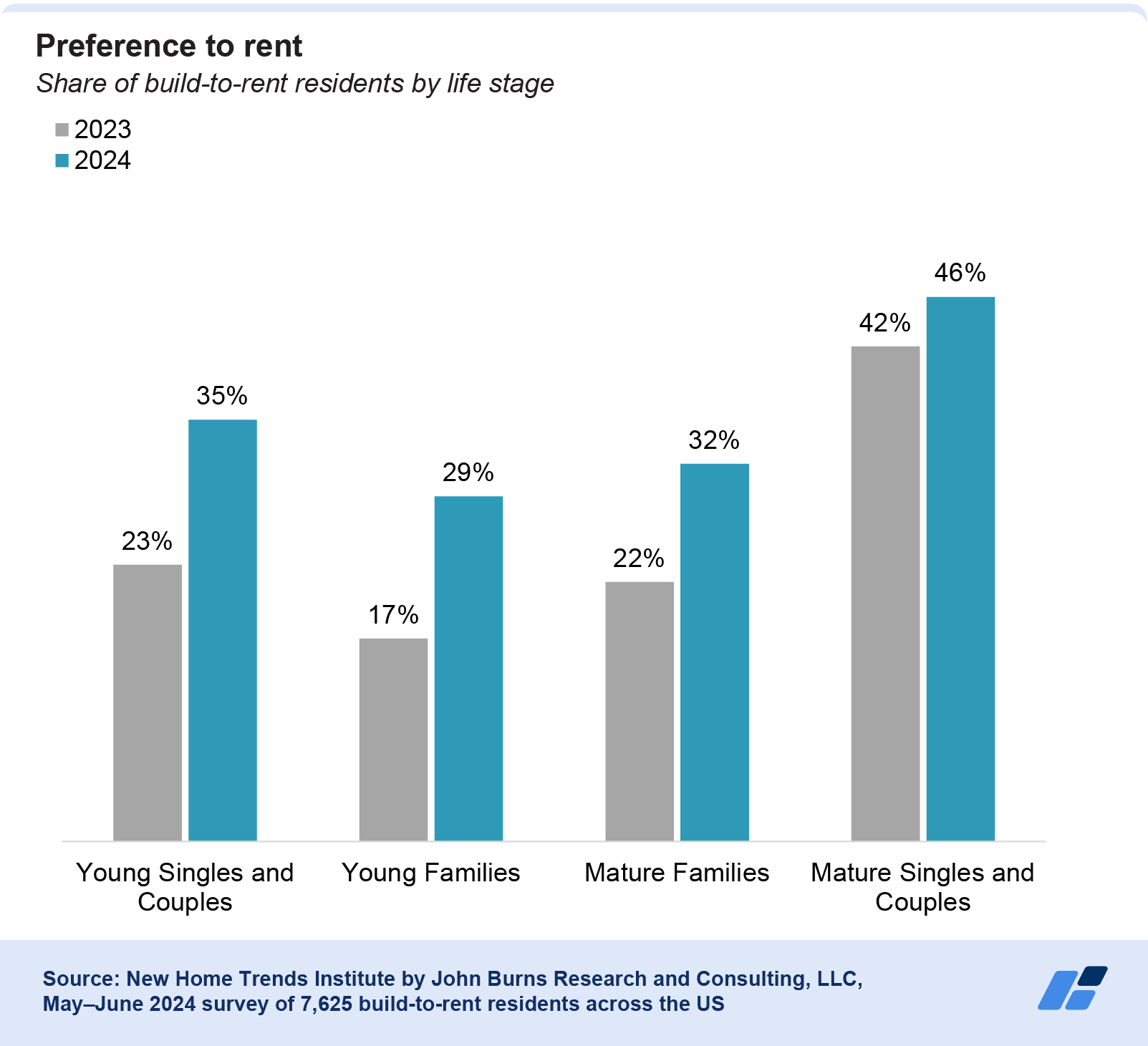

The preference for renting grew across all life stages:

- Young Singles and Couples: Up 12 percentage points

- Young Families: Up 12 percentage points

- Mature Families: Up 10 percentage points

- Mature Singles and Couples: Most likely to prefer renting, with 46% in 2024 (consistent with 42% in 2023)

Fewer BTR residents plan to buy a home next

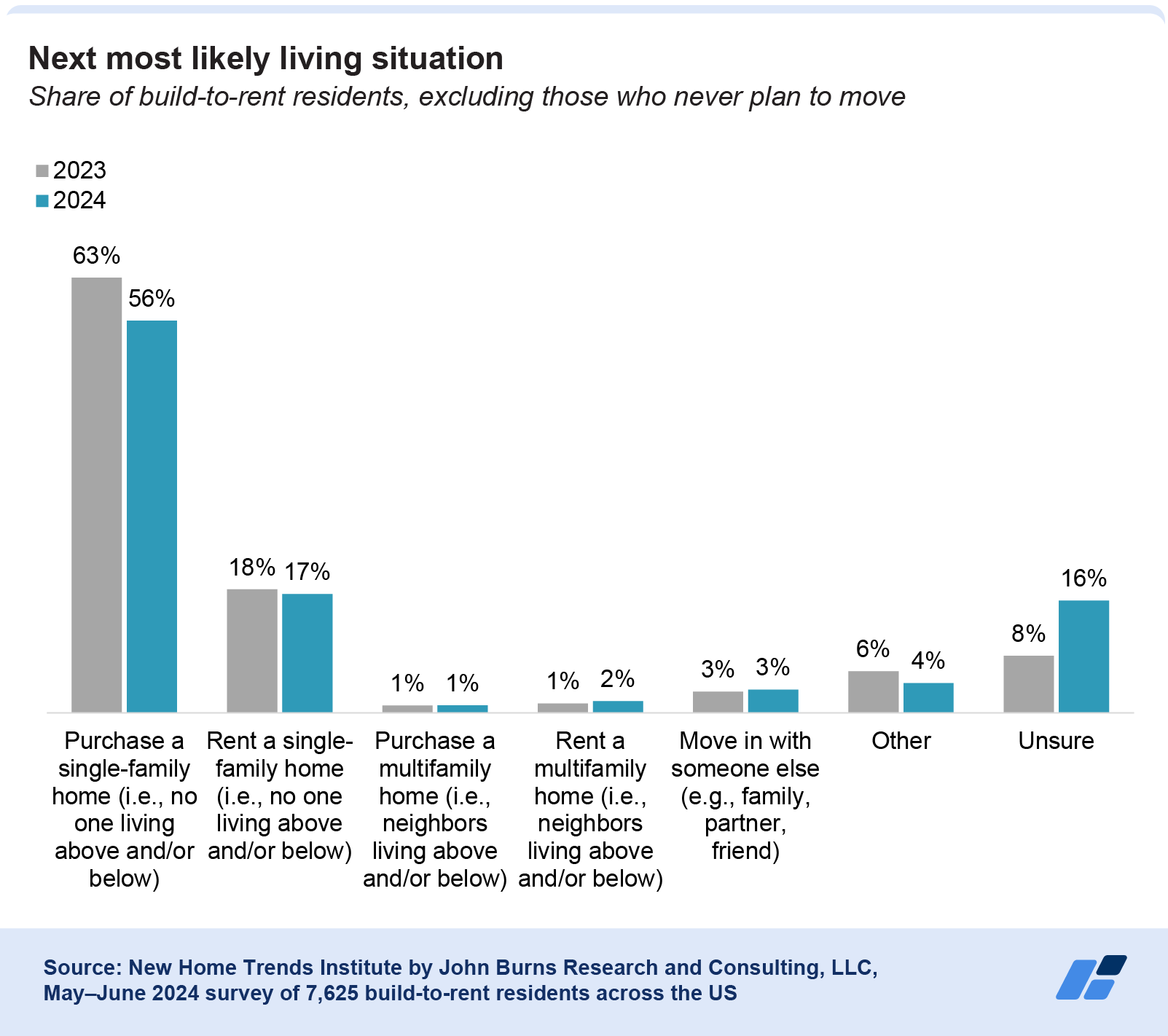

Despite no change in how long residents plan to stay in their current home (most expect to stay for a median of 3 years), fewer plan to buy a home next. The percentage of residents who plan to purchase a single-family home has dropped 7 percentage points since 2023, down from 63% to 56%. Meanwhile, the percentage of those unsure about their next living situation doubled, rising from 8% to 16%.

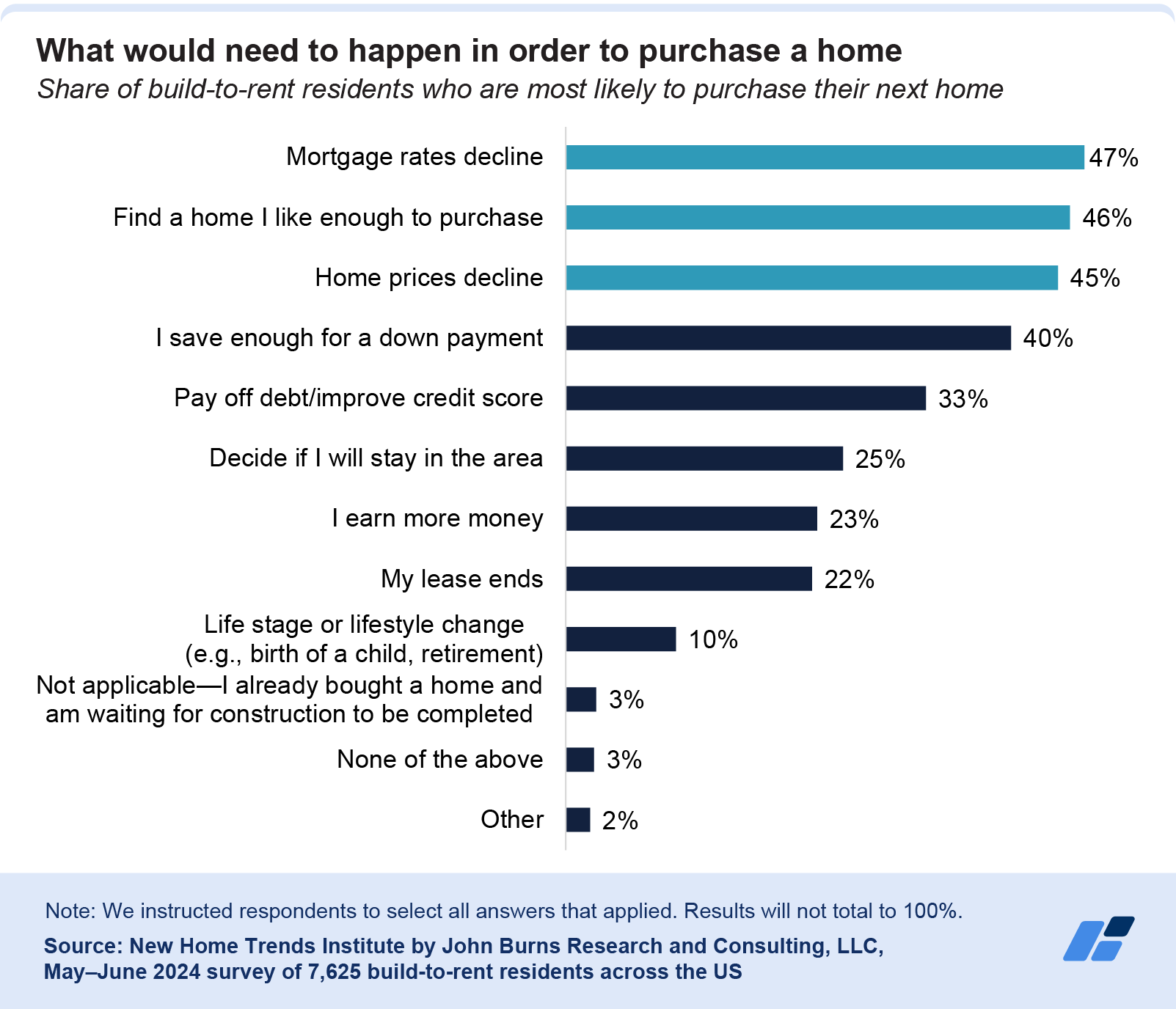

"The biggest hurdle to buying a home for BTR residents is high mortgage rates. Nearly half (47%) of residents said mortgage rates would need to drop before they could buy, compared to 40% who said they needed to save for a down payment."

These responses are no surprise, given the current affordability challenges. Last month, we reported that purchasing a starter home costs $1,091 more per month than renting one, on average.

More than 40% of BTR residents would move for lower rent

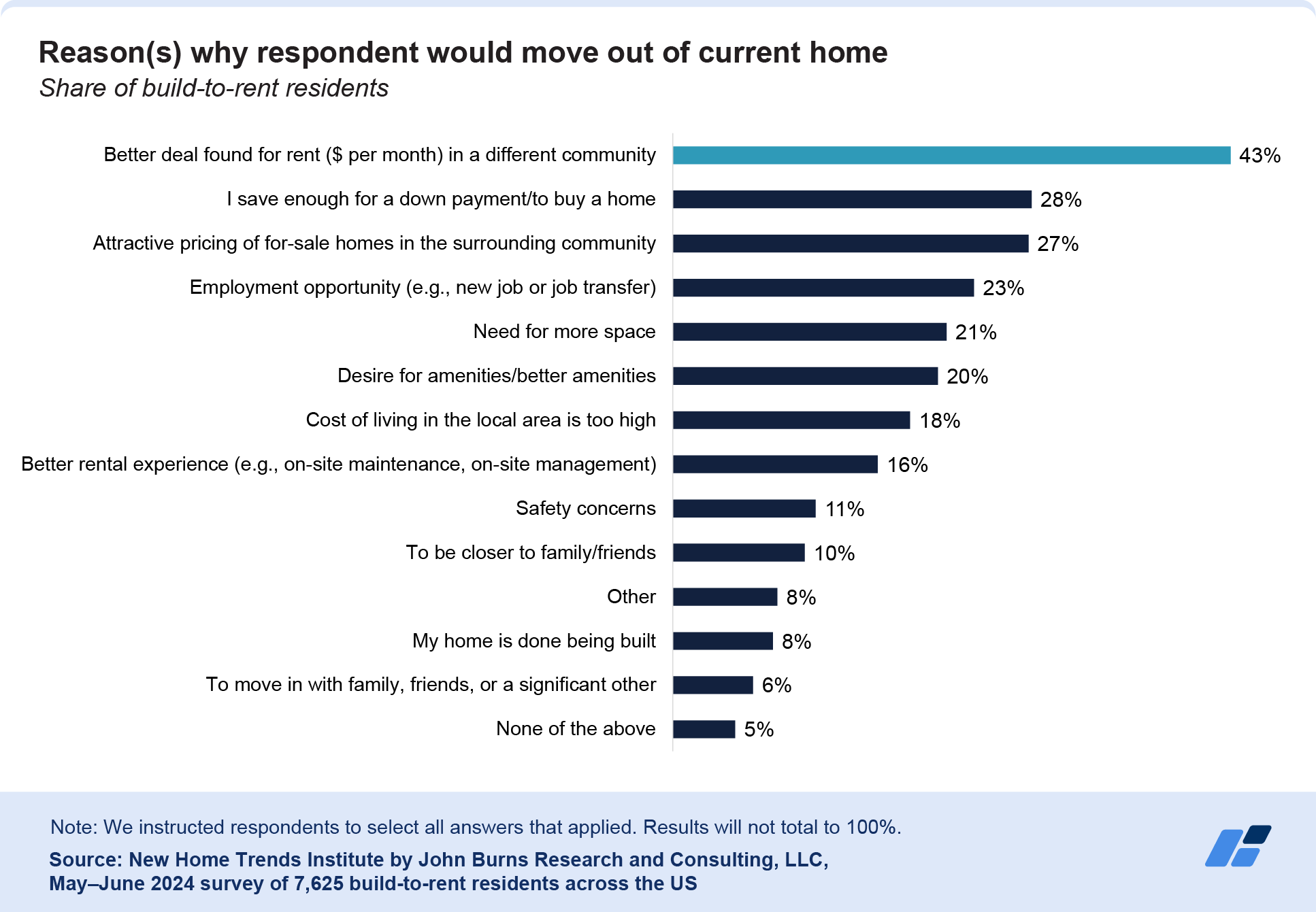

Looking ahead, continued high interest rates and home prices will likely keep housing affordability challenging. For BTR residents, this might mean renting longer than expected, since the majority (56%) still plan to purchase a home in the long run, or moving to find cheaper rent. According to our survey, 43% of residents would move out of their current home if they found a better deal on rent elsewhere.

Other reasons for moving were less common:

- 28% cited saving enough money to buy a home.

- 27% mentioned attractive pricing on homes for sale.

Although cost-conscious residents may be tempted to move to other rental communities, developers and operators can focus on home and community features that encourage residents to stay. Please contact us to learn more about the home finishes and features that matter (hint: don’t skimp on flooring or storage) and what influences residents’ rental decisions (on-site maintenance professionals are a big factor for most residents, so their reliability could hold a key to retention).

New Home Trends Institute members can access the full report here.

¹ Note: Formerly known as the Build-to-Rent Tenant Survey, we have since revised our language from tenant to resident.

Source: New Home Trends Institute by John Burns Research and Consulting, LLC, May–June 2024 survey of 7,625 build-to-rent residents across the US