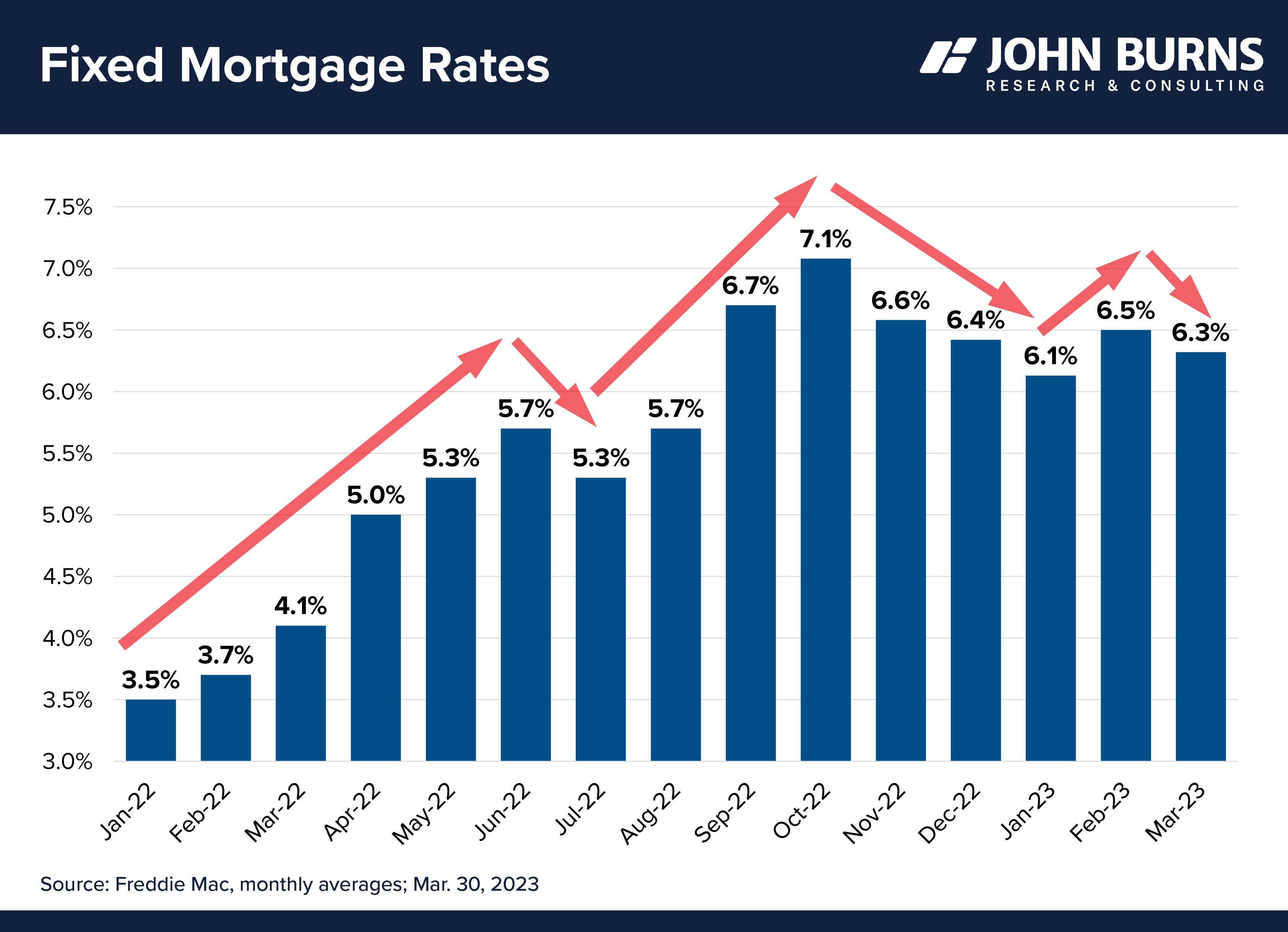

Changing mortgage rates have driven home buying demand over the last 15 months.

- Rising rates from January through June last year steadily slowed sales.

- Sales improved last summer as rates fell in July and August.

- Rates spiked in September and October, leading to poor sales in the seasonally slow fourth quarter.

- Rates then trended down through January, boosting sales early this year, rose in February, slowing sales, and then reversed course again in March, helping sales.

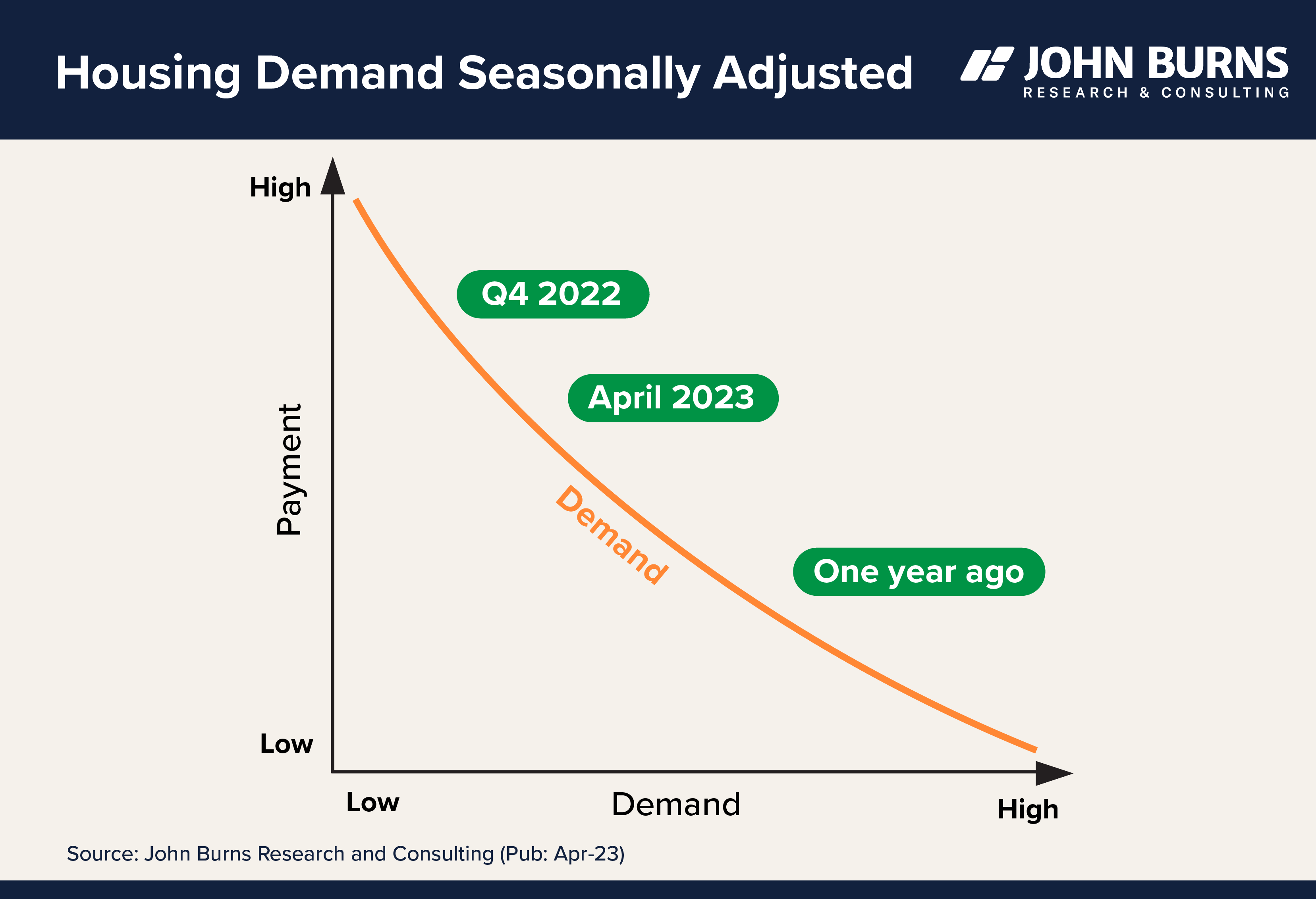

Our demand curve below illustrates what we see going on. As payments decline, demand goes up, and vice versa.

Mortgage rates below 5.5% work.

In late February and early March, our New Home Trends Institute team surveyed more than 1,300 homeowners and renters with household incomes of $50,000+ and learned that 55% believe now is a bad time to buy a home, while 22% think it is a good time to buy.

We also learned that 5.5% mortgage rates seem to be the tipping point.

- 62% of consumers believe a historically normal mortgage rate is below 5.5%.

- 71% of prospective home buyers who plan to purchase their next home with a mortgage say they are not willing to accept a mortgage rate above 5.5%.

Our consulting team has witnessed this across the country, noting that home builders who choose to subsidize buyers’ mortgage rates, bringing the overall rate down below 5.5%, have been achieving the most success. Many of the largest builders in the country have been buying mortgage rates down below 5.0%.

All in all, home builders are faring quite well.

- A lack of competition from the resale market is helping them tremendously.

- Paying as much as 6.0% of the mortgage amount to buy down mortgage rates has been relatively painless since builders had previously raised prices so much.

- Falling construction costs, especially lumber, have also helped.

Most importantly, home buying isn’t all about finances or timing the market. Our survey results show that needing more space and the desire for a better quality / newer home are what still drive most moves.

To learn more about how consumer sentiment on economic conditions and personal finances is impacting the housing market, please contact us.